WHAT IS BUSINESS CASH ADVANCE?

Fast, flexible business funding.

Don’t let cashflow slow you down! A Business Cash Advance (BCA) gives your business up to R1.5 million in funding, paid upfront so you get quick, easy capital that supports your business growth without any hassle.

Repayments are automatic and linked to your VodaPay Card Machine sales. A small percentage of each sale goes towards your advance balance, so you never have to worry about debit orders or missing a payment.

WHAT ARE THE BENEFITS?

Why apply for a Business Cash Advance

No collateral

You don’t need to put up business assets or property as collateral to qualify.

No hidden costs

Zero admin fees or initiation fees.

Easily pay it back

No need to set up a debit order. Repayments are automatic and linked to your sales.

Funding paid within 48 hours

You’ll get your funding in your bank account within 48 hours of approval.

HOW BUSINESS FUNDING CAN HELP

Some things you can do with the advance

INFO TO KNOW BEFORE YOU APPLY

What you need to get a Business Cash Advance

GET STARTED

How to get your Business Cash Advance

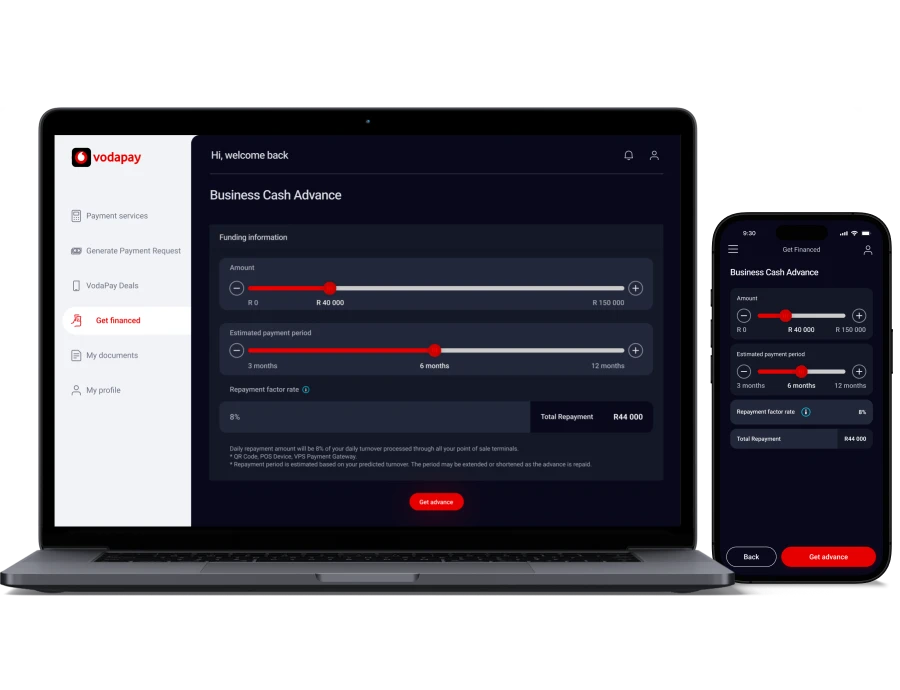

Go to the Merchant Portal

Log in to check if you qualify and apply in minutes.

Choose amount and repayment term

Decide how much funding you want and over how many months.

Receive the funds, fast!

Get access to your money without a lengthy wait.

Repay easily

Repayments are automatic, which means you’ll pay back your advance as you receive payments on your VodaPay Card Machine.

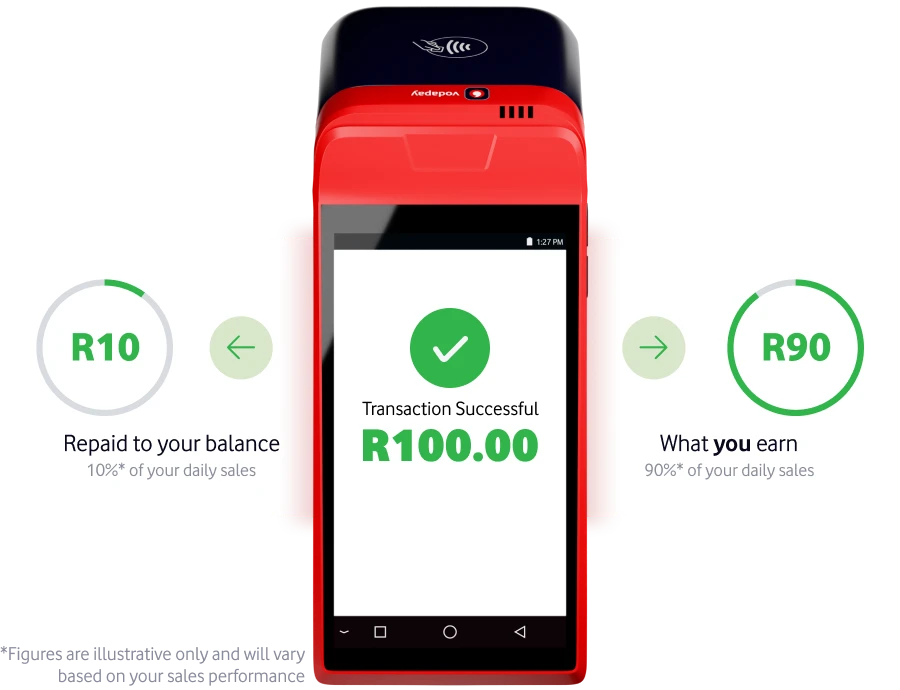

EXAMPLE OF FEE BREAKDOWN

How repayments work

A fixed percentage of your sales will go towards repaying the funding advance balance, making repayments stress-free.

Have more questions?

How is it different from a bank loan?

There are no fixed monthly repayments, interest rates or hidden fees. You repay more when your sales are strong, and less when they slow down. It’s fast, flexible, and designed to move with your cash flow, not against it.

Who can apply?

Any South African business that’s been trading for at least 4 months, uses a VodaPay Card Machine, and has consistent monthly sales. No paperwork or bank statements needed!

How much funding can I get?

You could qualify for up to R1.5 million, depending on your sales volume, consistency, and history. The more stable your sales, the better your chances of unlocking higher amounts.

How fast will the money arrive?

You can apply in minutes, and once approved, the funds typically land in your account within 48 hours.

Can I get more funding later (a ‘Top-Up’)?

Yes! Once you’ve repaid a certain amount (about half of the initial funding) and stayed on track, you may qualify for a Top-Up. It's a flexible way to unlock more cash when your repayment performance is strong.