VodaPay Max - The revenue generating machine

Discover the card machine tailored for South African businesses like yours. Accept credit cards, debit cards, and mobile wallets safely and easily.

Benefits of VodaPay Max Card Machine:

- Delivery is free

- No connection fee

- Track all your transactions

- Device insured for 12 months

- Register as a vendor to sell airtime, data, and utilities.

WHY THE MAX?

Flexible, affordable and profitable

Grow your cash flow, broaden your customer base, and boost profits with an efficient, easy-to-use VodaPay Max Card Machine.

Fast, safe & secure payments

Your customers can use their cards or digital wallets to safely tap, insert or scan to make a payment.

Increase revenue streams

Sell airtime, data and electricity straight from the VodaPay Max Card Machine. Customers can also pay fines, make EasyPay bill payments and even pay municipal bills. All from one card machine!

Stable connectivity

Don’t miss another payment! Our Dual SIM technology ensures you’re always connected.

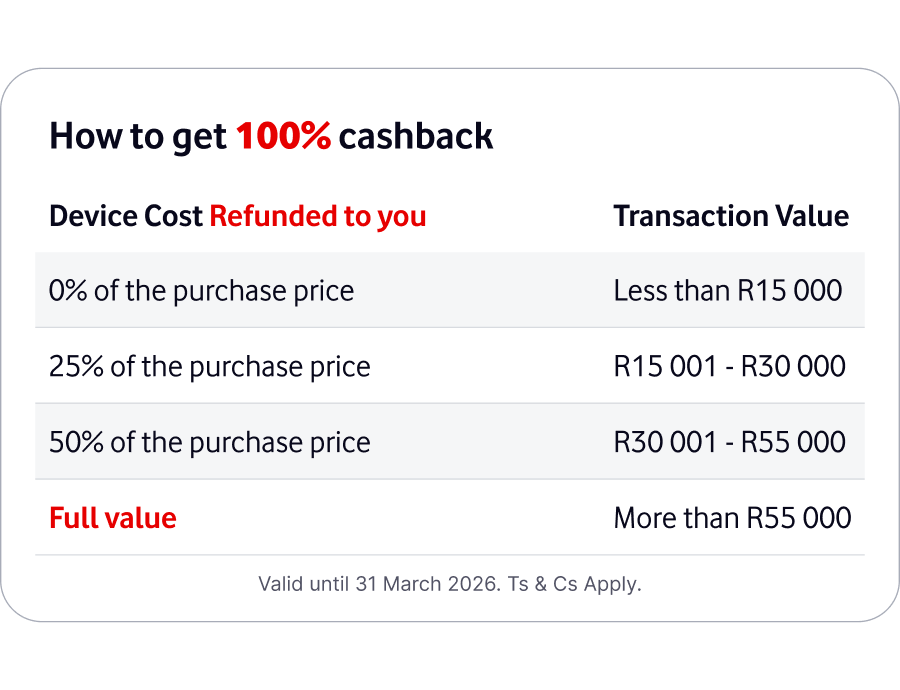

CASHBACK

Get up to 100% cash back

You could get a percentage of the purchase price of your VodaPay Max Card Machine back! Take a look at the table to see what you could get back into your bank account, based on your transaction value over 3 consecutive months.

EXTRAS

Enhance your business with VodaPay Max

With the VodaPay Max Card Machine you can sell more products and track all your sales in real time. You could also get access to up to R1.5 million in business funding.

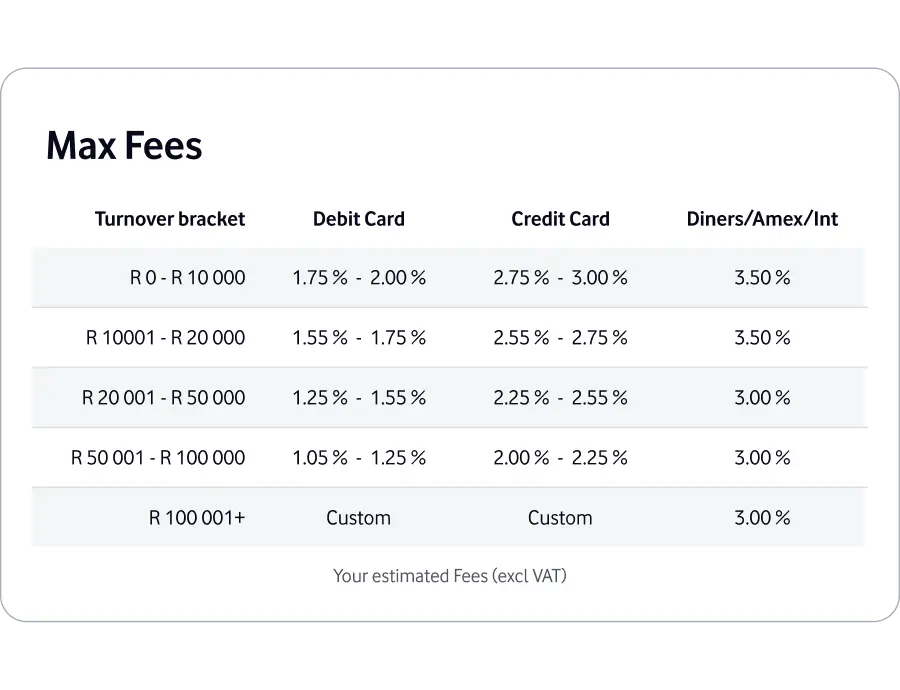

AFFORDABLE FEES

A fee structure designed to help you grow

We’re committed to helping you manage costs while growing your business. If your business doesn’t transact, we won’t deduct any fees. Plus, the more you transact, the lower your fees!

HOW TO

Get your VodaPay Max card machine

It's really easier to buy and activate a Vodapay Max card machine.

Buy online or instore

Get a VodaPay Max Card Machine online (free delivery) or at participating stores.

FICA

Submit your FICA documentations online, in-store or call the call centre.

Get your VodaPay Max & take payments

Whether you buy in-store or wait for your free delivery, the card machine is ready to use once you are FICA approved.

No connection fee to transact

There’s no connection fee, the device is ready to use once you’ve been FICA approved.

PAYMENT SOLUTIONS FOR ALL TYPES OF BUSINESS

Choose a payment solution that’s right for your business

You are spoiled for choice when it comes to choosing the right card machine or online payment gateway from VodaPay. We have everything from card machines to Payment Requests, Payment Gateways and even Tap on Phone solutions.

Card Machine Help & Support

Having trouble registering your payment solution?

Call Vodacom Payment Services Activations:

- 011 066 0847 and select 'option 2'

- Monday to Friday 07:00 am to 05:00 pm

For technical support for your payment solution

Contact Vodacom Payment Services Support:

- Toll Free - 0800 000 654

- WhatsApp - 072 606 9421

- [email protected]

- Email: [email protected] (for all vending queries)

- Available daily (including public holidays) 07:00 am to 07:00 pm

View Ts&Cs

Take a look at our full Terms & Conditions below.

FAQs

Max card machine questions and answers...

What business is best suited for the Max card machine?

The Max is perfectly suited for businesses that need a reliable payment solution that also helps them to attract more customers by selling more products.

Why do I need to FICA before I can rent a VodaPay Max card machine?

FICA, or the Financial Intelligence Centre Act, is a set of laws in South Africa aimed at preventing financial crimes like money laundering and terrorism financing. It requires financial institutions to verify your identity and monitor transactions for suspicious activity.

To FICA your Kwika card machine, you need to provide:

- South African ID or Foreign national documentation

- Proof of Banking

- Business Registration if you have a registered business.

- Confirmation Letter to confirm that you are a business representative.

This is a compulsory process that protects you, us and your customers from malicious transactions.